A year of growth across the Horizon portfolio

Amidst all the uncertainty in global markets, 2021 was a record year of growth for Horizon Capital and our portfolio companies. It was a year in which we invested to deepen our domain expertise and extend our powerful network as we build the preeminent Technology Services Buy and Build investor.

Horizon Capital provides the first institutional capital to high growth entrepreneurial led businesses and then delivers practical support as we lead them on intensive buy and build journeys. This unique combination resonates with ambitious entrepreneurs and during 2021 we have entered into four new partnerships to build businesses, that with our support, will grow to lead the markets in which they operate.

Growth Over 2021

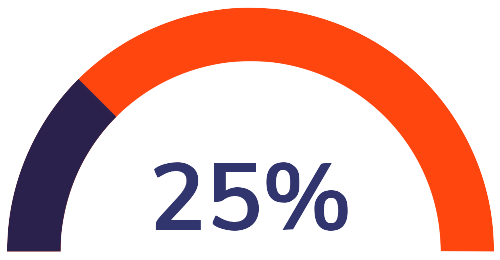

Aggregate EBITDA growth in past 12 months

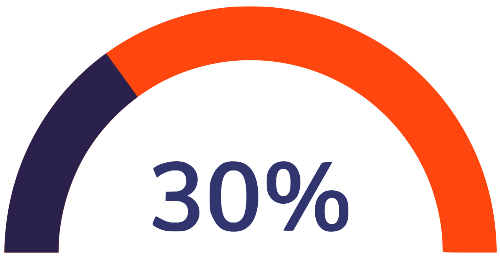

Aggregate revenue growth in past 12 months

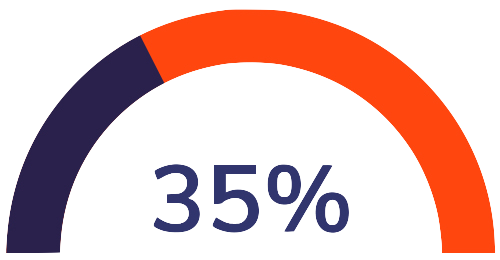

Growth in number of portfolio employees

Creating Market Leading Businesses

£82m of capital committed to 4 new partnerships with management teams ambitious to accelerate growth.

2021 was our most active year yet on new investments. In March we invested in The Marketing Practice which is a market leader in delivering tech enabled marketing services to the world’s largest technology businesses and is growing more than 35% year on year. Quickly followed in April with a commitment to a buy and build with Modern Networks which has already completed two highly accretive acquisitions. In November we took a controlling stake in BP3 a US / UK Robotic Process Automation provider growing at 35% organically. Closing the year in December we entered the highly fragmented compliance services market investing in Dains a technology enabled service provider to over 4000 SME clients.

£130m of Capital returned to investors

2021 saw us exit two investments returning £130m of capital to investors. Most notable was our realisation of Bellrock, which during our ownership completed 12 acquisitions, significantly enhanced its service offering with proprietary software and achieved a 3x money multiple return for our investors.

27 acquisitions completed for portfolio with a total Enterprise Value of £145m

2021 was also a record year for add on acquisitions with 12 of our 14 high growth companies completing acquisitions, the largest of which was the acquisition of Kingpin by The Marketing Practice, providing new capabilities for clients whilst also doubling the size of the group within two months of our investment. As we look ahead to 2022 we are working on 12 exciting acquisitions across the portfolio.

Step Change Growth in the Horizon Team with 5 New Joiners

Over the course of the year we have welcomed five talented professionals into the Horizon Capital team. Emily, Katherine, Anna, Chris and Talia significantly increase our capacity, diversify our experience and bring new expertise to the team.

Emily Hickley

Chris Snow

Katherine Woodfine

Talia Tabbara

Anna Fatakhova

Maintain a Lead on ESG

When we established Horizon in 2018 a commitment to leading our market on ESG was at the heart of our business plan. Our growth in 2021 enabled us to appoint a dedicated ESG lead to own and enhance our proprietary ESG programme. The year saw us complete carbon emission calculations across our entire portfolio and launch Horizon’s comprehensive ESG diligence which we executed on our 4 new platform investments.

And finally, 2021 saw the Horizon team move to our new home in the Shard

”We’d like to thank our ambitious management teams, our advisors and our investors for their continued support!